Introduction

‘Running fast in the wrong direction is worse than walking slowly in the right one.’ – something like this quoted by Simon Sinek on X

Today’s business arena demands not just speed, but also strategic agility. The true meaning of agility is also about moving continuously towards the right direction which might have been interpreted as just moving fast. Traditional methods of overseeing organizational investments often falter in this fast-paced environment, leading to wasted effort, protracted timelines and a disconnect between high-level strategy and on-the-ground execution. One of the reasons could be less tolerance of uncertainty & a focus on ‘making the perfect plan’, and then strategising to get the plan ‘right’.

Let’s understand the Lean Portfolio Management (LPM), a contemporary approach that injects Lean and Agile thinking into how organizations manage their most significant investments. This concise guide unpacks LPM and provides a tangible pathway for its adoption.

Before starting your journey to go through this quick guide, I would like you to remember a famous quote by futurist Alvin Toffler –

“The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn and relearn.”

What is Lean Portfolio Management?

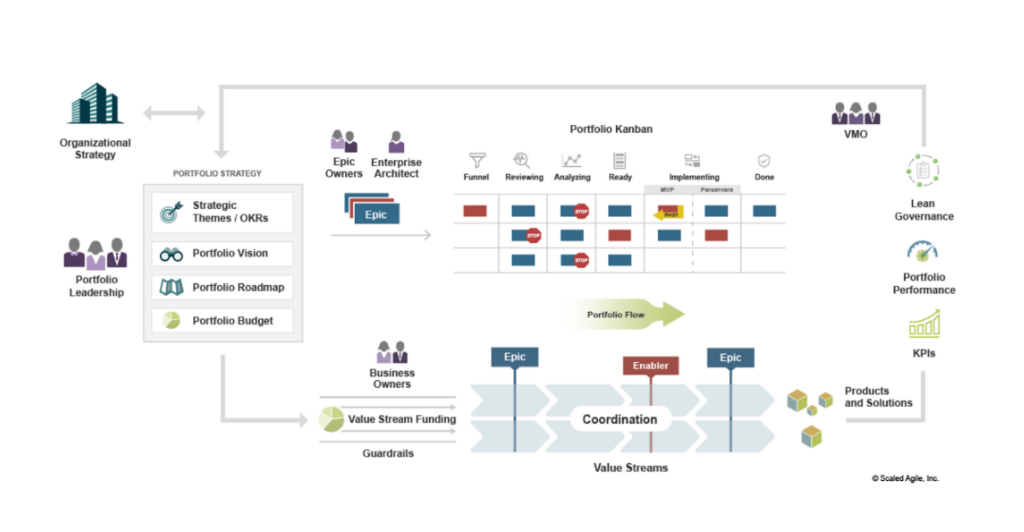

Scaled Agile Framework (SAFe) has introduced Lean Portfolio Management in Portfolio flow as a way to translate enterprise strategy pertaining to a portfolio for execution.

LPM transcends the conventional view of a portfolio as a mere collection of projects. Instead, it champions a holistic perspective focused on optimizing the continuous flow of value across the entire enterprise.

Think of LPM as the smart way for an organization to handle its big bets – its portfolio of products and initiatives. It’s not about setting things in stone and hoping for the best. Instead, LPM is designed to be really tuned in to how things are constantly shifting: what customers want, what new tech is out there, and just the general ups and downs of business.

The whole point? To build stuff that people genuinely love and that also makes good business sense. To pull that off, everyone needs to be on the same page, marching to the beat of the company’s overall strategy. LPM makes sure that connection is strong and clear.

One of the big wins of LPM is making the day-to-day work – the operational value stream – run like a well-oiled machine. It streamlines how ideas become actual products and services.

LPM really shines in three key areas:

- Smart Money Moves (Strategic and Investment Funding): This is not about throwing money at every bright idea. LPM helps organizations make thoughtful choices about where to invest, making sure the big projects actually line up with the company’s goals. It is about funding value streams – the ongoing ways you deliver value – rather than just individual projects, giving teams more flexibility.

- Keeping Things Agile at the Top (Agile Portfolio Operations): Just like your development teams use Agile to be nimble, LPM brings that same spirit to the portfolio level. It is about coordinating all the different moving parts, supporting the teams doing the work, and constantly looking for ways to improve how things run. Think of it as the conductor making sure the whole orchestra plays in harmony.

- Guiding Without Being Heavy-Handed (Lean Governance): No one likes a ton of red tape. LPM offers a lighter touch to oversight. It sets clear boundaries and expectations but empowers teams to make decisions. This includes smart ways to handle budgets, make forecasts, and keep an eye on how the portfolio is performing without slowing everything down.

How has Portfolio Management Evolved?

To truly grasp the significance of Lean Portfolio Management (LPM), it’s beneficial to trace the evolution of portfolio oversight:

- Using the business lens as a guiding light – In early portfolio management the most usual move was to diversify business holdings and mitigate risk across various operational units. This was creating structural overheads. The business lens enables us to move away from project thinking to outcome or value based thinking

- Shifting from project paradigm & moving towards product focus – As businesses matured, the emphasis shifted towards strategically managing a suite of products or services to enhance market penetration and profitability.

- Factoring the IT Imperative: With the increasing criticality of technology & the perks of its advancement, focus has shifted towards frequent & short releases to continuously delivering value to customer (desirability), benefits to the business (viability) and upskilling the technological skillset to deliver solutions (feasibility) aspects.

- Making transformation leaner & aligned to product vision: LPM represents the latest stage in this evolution, directly addressing the shortcomings of earlier approaches by prioritizing value streams, seamless flow, and adaptive planning. The roadmap shouldn’t be output or feature focused but outcome driven.

Why Lean Portfolio Management?

The impetus for adopting LPM stems from persistent challenges within organizations:

- The Drag of Long Cycles: Traditional portfolio governance often involves cumbersome approval processes and inflexible planning horizons, significantly delaying the realization of value from major initiatives. The annual planning itself created a bottleneck for organizations and hence required a mechanism to set guardrails in investment funding, more collaboration among stakeholders and driving my context not by command.

- Activity Without Impact: Organizations can be intensely busy executing projects, yet without a strong strategic compass, these endeavors may not contribute meaningfully to overarching business objectives. The practices like OKRs helped in setting objectives in context with customer & business and then identifying key results that could act as measure of success to create meaningful impact.

- The Rigidity of Budgets: Annual budget cycles can quickly become irrelevant in a fluid marketplace, hindering the ability to capitalize on emerging opportunities or respond effectively to market shifts. The practices like investment horizons as suggested by Lean Portfolio Management gives ability to fund, discontinue funding or pivot based on such market shifts and it requires continuous review of portfolio initiatives and decision making.

Key Elements of Lean Portfolio Management

LPM is underpinned by several fundamental principles and practices. Below is the cheat sheet to know everything about LPM as recommended by SAFe. It is broadly categorised in following 4 aspects:

1. Core Principles & Mindset

- Lean Thinking: Applying Lean principles (eliminate waste, amplify learning, decide as late as possible, deliver fast, empower the team, see the whole) to portfolio management. Focus on flow, value, and continuous improvement.

- Agile Principles: Extending Agile values and principles (customer collaboration, responding to change, iterative development) to the portfolio level.

- Decentralized Decision-Making: Empowering teams and individuals closer to the work to make decisions within established strategic and budgetary guidelines.

- Value-Centricity: Shifting focus from managing projects and activities to managing the flow of value to the customer.

- Economic Prioritization: Making investment decisions based on economic outcomes, considering factors like Cost of Delay (CoD), business value, risk reduction, and opportunity enablement.

2. Key Concepts & Terminology

- Strategic Themes: Business objectives and strategic initiatives that influence portfolio strategy and provide context for decision-making. They connect the portfolio to the enterprise strategy.

- Portfolio Vision: A future-state description of the portfolio, reflecting the Strategic Themes and desired outcomes. It provides a long-term perspective and guides investment decisions.

- Value Streams: Long-lived series of steps used to deliver value to a customer. LPM aligns funding and resources around Development Value Streams.

- Development Value Streams: The sequence of activities needed to deliver a continuously flowing stream of value in the form of products or services. LPM manages the flow of Epics through these streams.

- Solution: A product, service, or system delivered by one or more Agile Release Trains (ARTs) and Suppliers. LPM ensures Solutions align with the Portfolio Vision.

- Epic: A significant initiative that requires a Definition of Done, Definition of Ready, and business outcome hypothesis. Managed through the Portfolio Kanban.

- Business Epic: Directly delivers business value.

- Enabler Epic: Supports the architecture or exploration needed for future business value.

- Epic Owner: Responsible for defining the Epic, its business value, and collaborating with stakeholders throughout its lifecycle.

- Portfolio Kanban: A visual workflow management system for Portfolio Epics, limiting Work in Progress (WIP) and ensuring a continuous flow of value. States typically include Funnel, Review, Analysis, Portfolio Backlog, Implementing, Done.

- Lean Budgeting: Allocating budgets to Value Streams rather than individual projects, empowering ARTs to make decisions within those budgets.

- Guardrails: Policies, practices, and spending limits that provide guidance and autonomy within Lean Budgets.

- Participatory Budgeting (PB): A collaborative event where stakeholders collectively decide how to allocate the Lean Budget to the Portfolio Backlog Epics.

- Value Stream Management (VSM): Understanding, mapping, and optimizing the flow of value through Development Value Streams. LPM leverages VSM insights for continuous improvement.

- Architectural Runway: Existing code, hardware components, business rules, etc., that provide a technical foundation for future development. Enabler Epics contribute to extending the Architectural Runway.

- Non-Functional Requirements (NFRs) at Portfolio Level: System-wide quality attributes (security, performance, scalability) that must be considered across all Solutions within the portfolio.

- Metrics: LPM uses metrics to track portfolio health, flow, and value delivery (e.g., Epic lead time, WIP, business value achieved).

- Lean Portfolio Management Events:

- Portfolio Sync: Regular cadence-based meeting to review portfolio progress, discuss impediments, and make necessary adjustments.

- Strategic Portfolio Review: Periodic review of the Portfolio Vision, Strategic Themes, and overall portfolio performance.

- Participatory Budgeting: As described above.

3. Implementing LPM

- Establish the LPM Function: Identify key roles and responsibilities for guiding and facilitating LPM within the organization.

- Connect Strategy to Execution: Ensure a clear line of sight from enterprise strategy to the Portfolio Backlog through Strategic Themes and the Portfolio Vision.

- Fund Value Streams: Shift from project-based funding to allocating budgets to Development Value Streams.

- Implement the Portfolio Kanban: Visualize the flow of Epics and actively manage WIP.

- Empower Epic Owners: Provide them with the authority and support to drive their Epics.

- Bringing alignment through collaboration: Encourage collaboration between business and technology stakeholders at the portfolio level.

- Measure and Learn: Track relevant metrics to understand portfolio performance and identify areas for improvement.

4. Key Roles in LPM

- Lean Portfolio Management (LPM) Team: A cross-functional group responsible for strategy and investment funding, program management, and governance.

- Epic Owners: Drive individual Epics through the Portfolio Kanban.

- Enterprise Architects: Provide architectural guidance and ensure technical alignment.

- Business Owners: Key stakeholders who represent the business value and participate in decision-making.

How to Implement Lean Portfolio Management?

Adopting LPM is an evolutionary process, not an overnight switch. Here’s a pragmatic guide to initiate your journey:

1. Forming the LPM team by identifying the champions

- Pinpoint the key leaders and stakeholders who will actively advocate for and steer the LPM transformation. This typically involves senior executives from both business and technology domains. We recommend that LPM members should have practical experience of working with senior management, trained on systematic implementation of LPM, empowered to influence and drive changes.

2. Reimagine Funding

- Analyze existing funding models and explore pathways to adopt leaner budgeting practices that are more adaptable and directly linked to value delivery. We recommend increment approach like identifying the ongoing initiatives and mapping them against the strategic themes or OKRs, looking at the funds utilised and retrospect on needful decisions to make, identifying critical information like leading and lagging indicators to success of initiatives, the size of initiatives, bringing participatory budgeting approach and so on.

3. Visualize the Value Chain

- Begin mapping your organization’s value streams to pinpoint bottlenecks and opportunities for enhancing the flow of work. We recommend implementing a ‘portfolio Kanban’ to gain visibility into ongoing initiatives. Visualise the investment horizons. It might require re-org or revisit structure to be value focused.

4. Align with Purpose

- Start connecting your current initiatives to established strategic themes and prioritize them based on their potential to generate meaningful business value. We recommend introducing OKRs to establish clear targets and track progress. The OKRs best practices should be adhered to for effective results.

5. Iterate and Refine

- Continuously evaluate and improve your LPM processes based on feedback and empirical data. Cultivate a culture of transparency and collaborative engagement. We recommend implementing dashboards to visualise key metrics that could help in tracking the progress of the portfolio at all levels.

6. Celebrate Milestones

- Acknowledge early successes and recognize the contributions of teams embracing the new way of working. This helps to build momentum and solidify the transformation.

Let’s drill through it and understand how could LPM set up things at portfolio flow level –

Laying the foundation for Lean Portfolio Management

-

- Define clear Strategic Themes that connect the enterprise vision to portfolio initiatives. These themes provide context for all portfolio decisions. The Portfolio Vision articulates the desired future state driven by these themes.

- Formalize roles like Epic Owners, responsible for defining and driving Epics, and Enterprise Architects, who ensure technical alignment across the portfolio. These roles collaborate on the Portfolio Backlog.

- Build the Portfolio Backlog, this backlog contains strategic initiatives (Epics) prioritized based on their alignment with Strategic Themes and potential value. Include Non-Functional Requirements (NFRs) at the portfolio level to ensure system-wide qualities.

- Shift from traditional project budgeting to Lean Budgets allocated to Value Streams. Establish Guardrails – policies and spending guidelines – to empower decentralized decision-making within these budgets.

- Engage stakeholders in Participatory Budgeting events to collaboratively allocate budgets to Epics, advocating transparency and shared ownership.

Conclusion

Lean Portfolio Management or LPM offers a potent framework for navigating the complexities of today’s dynamic business environment. By prioritizing value delivery, spearheading strategic alignment, and embracing continuous improvement, LPM empowers organizations to become more agile, responsive, and ultimately, more successful in achieving their strategic objectives. This practical guide provides an initial roadmap for your LPM journey. Embrace the principles, learn iteratively, and unlock the full potential of your organizational portfolio. Partner with experienced SAFe agile consulting firms like Benzne to leverage external SMEs to enable your LPM journey.

With this, our blog on “What Is Lean Portfolio Management and How To Implement?” comes to an end and we sincerely hope this has given you the understanding of Lean Portfolio Management and how to implement it. Please write to us at consult@benzne.com for any feedback or suggestions or if you want Benzne agile transformation company to support your organizational agile transformation journey.

FAQs on Lean Portfolio Management

1. Who steers Lean Portfolio Management?

The responsibility for LPM is a collective one, shared among organizational leadership, portfolio management professionals, and the delivery teams. It necessitates a collaborative and aligned effort. The representation of people from the value stream, business leadership, enterprise architecture could be helpful additions.

2. What’s the starting point for Lean Portfolio Management?

Begin by gaining a clear understanding of your current operational landscape, engaging key stakeholders, and focusing on applying LPM principles to one or two key value streams as a pilot.

3. What tangible benefits does LPM offer?

The advantages of LPM include accelerated delivery cycles, enhanced strategic alignment, improved transparency across the organization, more efficient resource allocation, and a greater capacity to adapt to evolving market conditions. It could also provide a sense of purpose to the workforce at execution level and onboard them to the same boat.

4. Is there a minimum investment threshold for portfolio management?

The principles of LPM are applicable regardless of the portfolio’s financial scale. The focus remains on maximizing the value derived from the investments being made.

5. Which organizations stand to benefit from portfolio management?

Any organization managing multiple initiatives, products, or services with the aim of achieving strategic objectives can leverage portfolio management to optimize resource allocation and enhance value delivery.