On-time delivery with 95% success rate in a business-critical program of 25 teams

in an org wide waterfall to agile transformation.

How to implement agile for Payment clients?

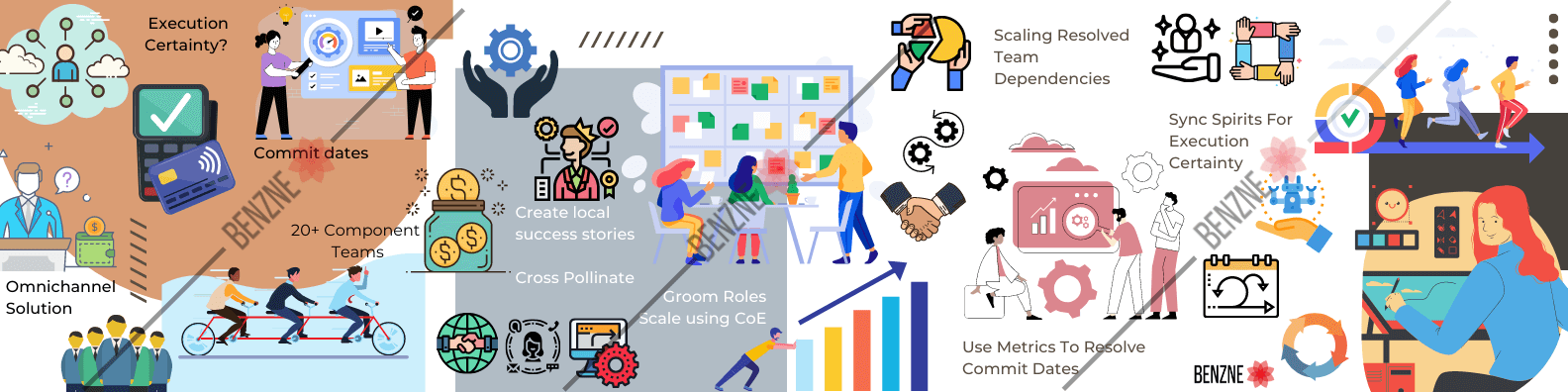

Our client is creating an omnichannel solution that, once developed, will replace the specific regional solutions & has more than 20+ components who need to work in tandem to deliver against the market commit dates. Leadership wants execution certainty at all levels – from individual performance till portfolio success.

With cross geographical teams working towards the same goal, there was a need to streamline Intake of work at a portfolio level, plan smaller increments, manage dependencies and have common agile frameworks implemented across the teams.

Teams were running their own execution cycles, and hybrid models of delivery with very less metric systems in place. A common understanding of metrics and dashboards was required to help the portfolio to take key data driven decisions.

Business drivers :

Transparency, Predictability & Time to market

End-user satisfaction

Measurable outcomes/productivity

Cost saving, Performance Optimization, Continuous Monitoring & Quality

A Group size of 130+ engineers across 22 component teams involving 6 geographical regions were trained and coached on agile ways of working. Paired coaches worked closely with the teams for 12 months. We did Role based coaching for 10 Product owners and 20 Scrum masters

Agile information radiators like physical boards were set up for all teams. We Implemented agile metrics for all teams like Burndown chart and Velocity chart for team level prediction. Role specific COEs for cross pollination of practices and knowledge were created.

Discovery sessions were introduced to size the project, predict the completion date and creation of backlog. SAFe practices were adopted like Scrum of Scrums for better dependency management and risk management. Common metrics were introduced and dashboards for effective tracking and creating visibility. Cadences for all teams were synchronized to streamline dependencies and smooth delivery of work items. Kanban boards were set up to track external team dependencies & Agility Health Assessment were done to track agile maturity at team levels. Setting up of portfolio kanban to visualize the flow of value delivery to the customer.

Pilot : Started with creating 4 success stories.

Stabilize : Sustained discipline, rigor and cadence during sprinting.

Scale: Scaled business agility across all components throughout the Omnichannel solution.

Training and Coaching promoted all 22 component teams to have common understanding of process and frameworks. Role based clarity with responsibilities were set which increased ownership among people. Discovery sessions enabled teams to ensure minimum blast radius by reducing risks, upfront understanding the dependencies before committing a date of delivery. Scrum of scrums resolved Inter-team dependencies & alignment to shared goals in parent backlog.

Burndown chart & velocity tracking minimized commit dates anomalies. Sprint cycles of all 20+ component teams were synced to bring program level transparency & predictability. Control charts to visualize waste & reducing lead & cycle time at portfolio level. Cumulative flow diagram helped us in managing input queue & workload

Frequent reviews at component, inter-component & region level helped us visualizing end to end workflow & improving regression cycles to promote continuous testing and seamless production release.

Agile COE ensured continuous learning culture in the portfolio